Selling a home quickly is no longer a luxury but a necessity, with over 27% of transactions now closing within 30 days of listing, according to a recent report by the National Association of Realtors. But finding the right approach can be tricky. Two popular options, 72SOLD and cash buyers, promise fast sales, but which one delivers? This guide, based on just 990 real estate reviews, compares 72SOLD and cash buyers to help you make an informed decision.

Toc

In today’s fast-paced real estate environment, the urgency to sell a home quickly can stem from various factors such as job relocations, financial difficulties, or personal circumstances. Traditional home sales often drag on for more than two months, leaving homeowners in a challenging position. With over a quarter of home transactions now completed within 30 days, it’s essential to explore alternative methods that promise expedited sales.

This article will delve into two leading options: 72SOLD and cash buyers. By examining their unique approaches, we aim to provide clarity on which method might best suit your needs.

72SOLD: The 8-Day Home Sale Promise with just 990 real estate reviews

72SOLD has carved out a niche in the real estate market by focusing on rapid home sales. Their business model revolves around creating urgency, aiming to sell homes in 8 days or less.

The 72SOLD Process

The process begins with a comprehensive evaluation of your property, followed by a tailored marketing strategy. Agents at 72SOLD utilize a “showtime” approach, where all potential buyers are invited to view the home on a single day. This method is designed to foster competition and drive up offers, creating a sense of scarcity that can lead to quicker sales.

72SOLD’s model particularly appeals to sellers facing time constraints, such as those relocating for a new job, needing to downsize quickly, or experiencing financial hardship. For instance, a family moving across the country for a job transfer might find 72SOLD’s 8-day promise appealing, as it allows them to expedite the sale and avoid the potential complications of a longer closing process.

Examining 72SOLD’s Claims

72SOLD makes bold claims regarding its success rates, stating that homes sold through their system often fetch sale prices that are 8-12% higher than those listed on the local MLS. While these statistics are impressive, it’s crucial to remember that individual experiences can vary, and there are no guarantees.

Pros and Cons of 72SOLD

Pros:

- Rapid Selling Timeline: 72SOLD aims to sell homes within 8 days, which can be a significant advantage for sellers needing quick cash.

- Potential for Higher Sale Prices: Many sellers using 72SOLD have reported achieving sale prices that surpass local market averages, leaving them with more money in their pockets and a sense of accomplishment.

- Professional Marketing Support: The company provides comprehensive marketing strategies, ensuring that your home receives maximum exposure to potential buyers.

Cons:

- No Assurance of Sale Price or Timeline: While 72SOLD promotes quick sales, there are no guarantees that your home will sell within the promised timeframe or at your desired price.

- Variable Agent Quality: The effectiveness of your sale can depend heavily on the quality and dedication of the assigned agent, which can vary significantly.

- Limited Flexibility: The structured nature of the 72SOLD process may limit your ability to negotiate terms or adjust closing dates to your preference.

While the “showtime” approach can create urgency and drive competition, it can also limit the number of potential buyers who can view the property. Some sellers may prefer a more traditional approach, allowing for individual showings and a wider pool of potential buyers.

Cash Buyers: A Quick Sale, But at What Cost?

Cash buyers offer an alternative for homeowners looking for a hassle-free and swift selling experience. This category includes various entities, such as iBuyers and house flippers, who can provide cash offers and close sales in a matter of weeks.

Types of Cash Buyers

- iBuyers: These technology-driven companies, like Opendoor and Offerpad, which together control a significant share of the iBuyer market, assess home values using algorithms to make cash offers. They typically close transactions quickly but may charge higher service fees. iBuyers have streamlined processes that appeal to tech-savvy sellers who prioritize convenience.

- House Flippers: Companies such as We Buy Ugly Houses specialize in purchasing properties that may require repairs, often at a lower price than market value. Their quick closing times appeal to sellers needing fast cash but can mean sacrificing a higher sale price for speed.

- Local Investors: Many local real estate investors also provide cash offers, sometimes resulting in better terms than national companies. They often have a deeper understanding of the local market and can provide personalized service.

Cash buyers are motivated by different factors. iBuyers, for example, seek to acquire properties to flip or rent out, often using technology to streamline the process. House flippers, on the other hand, focus on purchasing properties requiring repairs, aiming to renovate and resell them for a profit. Local investors might seek to add properties to their portfolio or acquire rental properties in specific neighborhoods.

1. https://banktop.xyz/mmoga-the-best-online-real-estate-courses-for-aspiring-california-agents

2. https://banktop.xyz/mmoga-top-real-estate-agents-in-atlanta-ga-your-key-to-unlocking-your-dream-home

3. https://banktop.xyz/mmoga-finding-the-best-real-estate-agents-in-miami-your-guide-to-success

4. https://banktop.xyz/mmoga-finding-the-best-real-estate-agent-in-san-antonio-for-your-family

Pros and Cons of Cash Buyers

Pros:

- Guaranteed Quick Sale: Cash buyers can typically complete sales within 1-3 weeks, which can be ideal for homeowners facing urgent financial needs or personal circumstances.

- No Need for Repairs or Cleaning: Sellers can often sell their homes as-is, without the need for costly repairs or extensive cleaning, which can save time and money.

- Avoidance of Realtor Commissions: Cash buyers typically don’t charge commissions, allowing sellers to keep more of the sale proceeds.

Cons:

- Lower Offers: Cash buyers typically offer between 70% and 80% of the home’s market value, often less than traditional buyers, depending on the property’s condition and location.

- Limited Negotiation Power: The straightforward nature of cash offers can limit the seller’s ability to negotiate terms or price, which may not be suitable for everyone.

- Risk of Predatory Practices: Some cash buyer companies may employ aggressive tactics or offer unfair prices, making it essential to research and choose reputable buyers.

While cash buyers typically offer below market value, some are open to negotiation, especially if the property requires repairs or has unique features. Sellers can leverage their knowledge of the local market and their property’s specific attributes to potentially secure a better offer.

72SOLD vs- Cash Buyers: Finding the Right Fit

When considering a quick sale, both 72SOLD and cash buyers offer distinct advantages and challenges. Understanding the key differences can help you choose the option that best aligns with your priorities.

Comparing Selling Timelines

Both options are designed for quick sales, but they differ in timelines. 72SOLD aims to sell homes in 8 days, while cash buyers generally close transactions within 1-3 weeks. If speed is your primary concern, cash buyers may offer the fastest route to closing.

Market conditions play a crucial role in deciding between 72SOLD and cash buyers. In a seller’s market, where demand outweighs supply, homeowners might achieve better prices using 72SOLD’s competitive marketing approach. However, in a buyer’s market, where inventory exceeds demand, cash buyers could offer a more reliable option, as they are less affected by market fluctuations and can close transactions quickly.

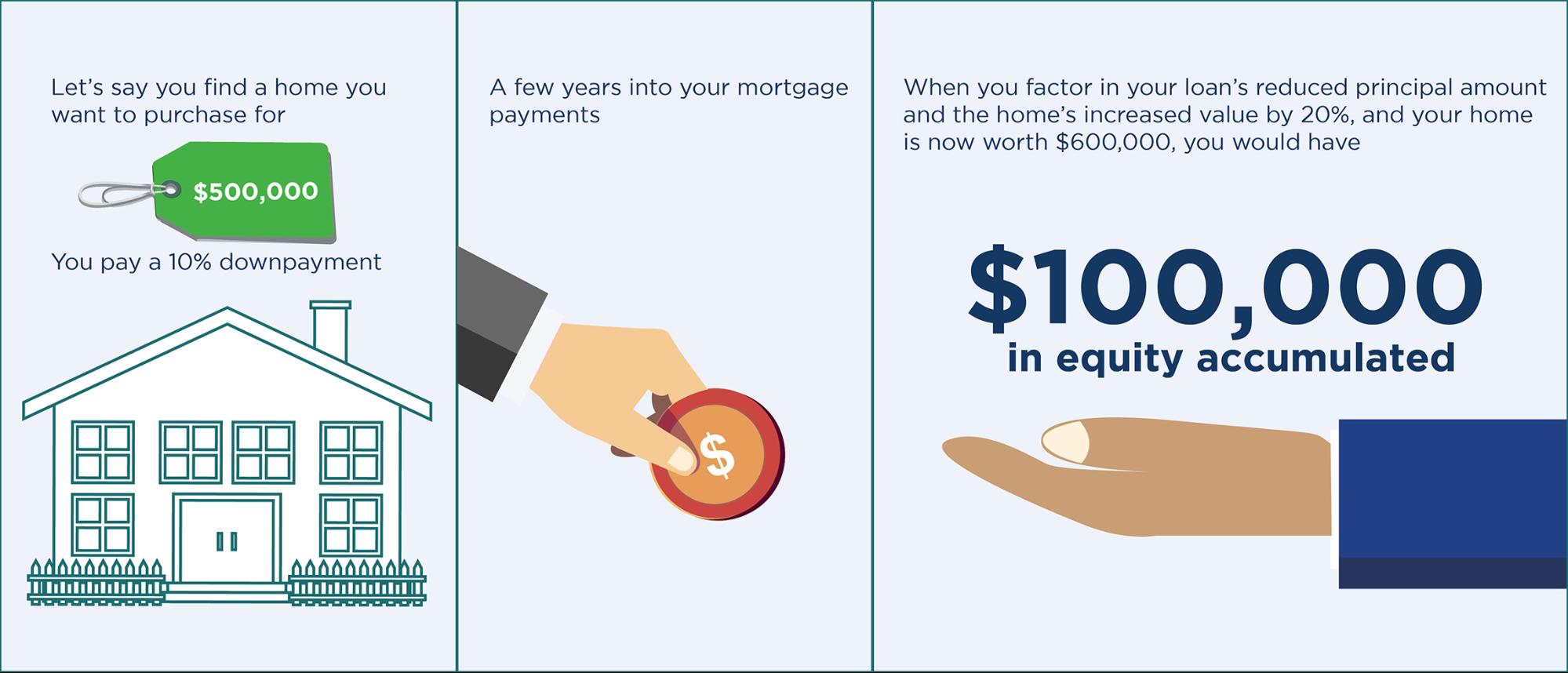

Evaluating Potential Sale Prices

One of the significant advantages of 72SOLD is the potential for higher sale prices, with claims of achieving up to 12% more than traditional sales. In contrast, cash buyers typically offer between 70% and 80% of the home’s market value, often less than traditional buyers. It’s essential to weigh the urgency of your sale against the potential financial impact of accepting a lower offer.

Flexibility and Negotiation Power

72SOLD provides a more traditional selling experience, with opportunities for negotiation, while cash buyers often present a straightforward, no-frills approach that may limit your ability to negotiate terms. If flexibility is essential to you, 72SOLD might be the better option. However, if you prioritize a quick and uncomplicated sale, cash buyers may suit your needs.

Decision-Making Framework

To decide between 72SOLD and cash buyers, consider your priorities:

- Maximizing Sale Price: If getting the highest possible sale price is your goal, 72SOLD may be worth the investment in time and effort.

- Speed and Convenience: If you need cash quickly and prefer a hassle-free process, cash buyers could be your best bet.

- Market Conditions: Assess current market conditions. In a seller’s market, you might achieve a better price with 72SOLD. In a buyer’s market, cash buyers could offer a more reliable option.

While 72SOLD and cash buyers are popular options, other methods can also expedite the home selling process.

Other Quick Home Sale Options

Exploring iBuyers

iBuyers like Opendoor and Offerpad, which together control a significant share of the iBuyer market, offer a technology-driven solution, providing cash offers and quick closings. Their algorithms assess market conditions, allowing for competitive pricing while ensuring a fast sale. Many sellers appreciate the ease of the process, as it often includes online evaluations and minimal in-person showings.

House Flippers

House flippers focus on properties needing repairs, often offering cash for homes in less-than-perfect condition. While their offers may be lower, the speed of the process can be appealing for sellers in urgent situations. If your home requires significant repairs, selling to a house flipper may be a viable option.

Local Investors

Connecting with local real estate investors can sometimes yield higher offers than national cash buyer companies. Their familiarity with the local market may allow for more competitive pricing. Additionally, local investors often provide a personalized experience, which can be beneficial for sellers looking for support and guidance throughout the process.

1. https://banktop.xyz/mmoga-finding-the-best-real-estate-agents-in-miami-your-guide-to-success

2. https://banktop.xyz/mmoga-the-best-online-real-estate-courses-for-aspiring-california-agents

4. https://banktop.xyz/mmoga-finding-the-best-real-estate-agent-in-san-antonio-for-your-family

5. https://banktop.xyz/mmoga-top-real-estate-agents-in-atlanta-ga-your-key-to-unlocking-your-dream-home

Clever Offers

Clever Offers is a platform that enables sellers to compare multiple cash offers from a network of reputable investors, providing a comprehensive view of available options. This can be particularly useful for homeowners unsure about which route to take, as it allows for easy comparison of offers and terms.

Analyzing Future Real Estate Trends

The real estate market is continuously evolving, influenced by a range of economic, technological, and societal factors.

The integration of smart technology in homes

It offers numerous benefits, enhancing both functionality and appeal. Smart technology such as energy-efficient lighting, automated climate control systems, and intelligent security solutions are becoming standard features sought by buyers. As more consumers prioritize sustainability and convenience, incorporating smart home elements can increase property value and attract tech-savvy buyers.

Remote Work and Housing Demand

The shift towards remote work has reshaped housing preferences, with many seeking homes that accommodate a home office and offer more living space. This trend has spurred demand in suburban and rural areas, previously overlooked by homebuyers looking for urban convenience. Sellers in these regions may find increased interest and competitive offers as more individuals embrace flexible work arrangements.

Evolving Demographics

Demographic shifts, including aging populations and increased immigration, also impact housing markets. Baby boomers may look to downsize or move to assisted living facilities, while younger generations and immigrants search for starter homes or rentals. These changes require sellers to be adaptable, creating opportunities to market properties to varied buyer segments and focusing on features that meet diverse needs.

Economic Factors

Finally, economic factors such as interest rates and inflation directly influence market trends. Lower interest rates tend to boost buyer affordability, leading to increased demand, while higher rates can cool the market. Economic conditions and government policies will continue to shape buyer behavior, making it crucial for sellers to stay informed and adjust strategies accordingly.

Another emerging trend is the growth of sustainable and eco-friendly housing. As environmental awareness increases, so does the demand for properties with green certifications and features designed to minimize carbon footprints. Lastly, as urbanization continues, mixed-use developments are becoming more popular, combining residential, commercial, and recreational spaces to create thriving, self-sustained communities.

Understanding these trends will be crucial for homeowners and investors aiming to capitalize

Conclusion

In the fast-evolving world of real estate, homeowners are increasingly seeking quick sale options. Both 72SOLD and cash buyers present unique advantages and challenges. By understanding their differences and considering real estate reviews, you can make an informed decision that aligns with your priorities. Whether you aim to secure a higher sale price or a swift transaction, evaluating your options carefully will enable you to navigate the complexities of selling your home successfully.

Ultimately, the right choice will depend on your individual circumstances, urgency, and financial goals. By taking the time to explore all available options, you can confidently move forward with your sale and transition to the next chapter of your life.

With the increasing adoption of virtual home tours and online platforms, the home selling landscape continues to evolve, offering homeowners more options for quick and efficient transactions.